Compound Interest Calculator - Frequently Asked Questions

The more you learn, the more you earn.

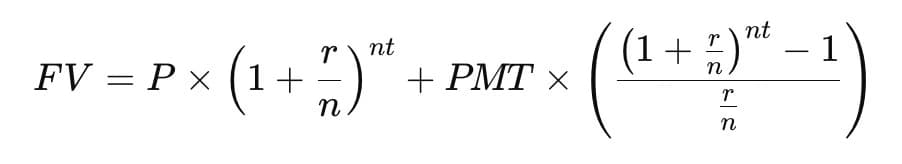

There are different ways to calculate compound interest depending on your needs. Our compound interest calculator uses advanced financial formulas to account for both the growth of the initial principal and the impact of regular contributions.

The Complete Formula:

Key Variables:

- FV: Future Value (final amount)

- P: Principal (initial deposit)

- r: Annual interest rate (as decimal)

- n: Compounding frequency per year (daily=365, monthly=12, etc.)

- t: Time period in years

- PMT: Regular payment/contribution amount per period

Our calculator is designed for serious investors and financial planners, providing detailed and precise projections of your investment's future value. Unlike simpler calculators, our tool accounts for various compounding frequencies and regular contributions to give you the most accurate results.

Daily (n=365)

Interest calculated 365 times/year. Best for high-frequency trading.

Monthly (n=12)

Interest calculated 12 times/year. Standard for savings & CDs.

Annual (n=1)

Interest calculated once/year. Common for bonds.

More frequent compounding generally results in higher returns because interest is added to your principal more often.

- Enter Initial Deposit (P): Start with the amount you're investing.

- Choose Frequency (n): Select daily, monthly, quarterly, or annually.

- Set Interest Rate (r): Enter the annual rate (e.g., 5%).

- Specify Time (t): How long will your money grow?

- Add Contributions: Optional regular deposits.

Quick Example:

$10,000 at 5% monthly for 10 years with $100/mo contribution = $26,800 total value.

A compound interest calculator is a financial tool that helps you calculate how your money grows over time when interest is added to your principal and then earns interest itself. Unlike simple interest calculators that only calculate interest on the principal, a compound interest calculator accounts for the exponential growth that occurs when interest compounds.

Our compound interest calculator supports multiple compounding frequencies:

- Daily compounding: Interest calculated 365 times per year

- Monthly compounding: Interest calculated 12 times per year

- Quarterly compounding: Interest calculated 4 times per year

- Semi-annual compounding: Interest calculated 2 times per year

- Annual compounding: Interest calculated once per year

This makes it ideal for calculating investment growth, savings account returns, loan interest, and retirement planning scenarios.

Yes! Our compound interest calculator is 100% free with no registration, sign-up, or hidden fees required. You can calculate unlimited scenarios for your investments, savings, loans, or retirement planning without any cost.

We believe financial planning tools should be accessible to everyone, whether you're a student learning about compound interest, an investor planning your portfolio, or a financial professional working with clients.

What you get for free:

- Unlimited calculations with no restrictions

- Support for all compounding frequencies

- Regular contribution calculations

- Detailed breakdown of results

- No ads or interruptions

- No personal information required

Our compound interest calculator is highly accurate and uses precise financial formulas trusted by professional investors and financial planners. The calculator implements the standard compound interest formula with support for regular contributions, ensuring mathematically correct results every time.

Accuracy features:

- Uses industry-standard financial formulas

- Accounts for exact compounding frequencies (daily, monthly, quarterly, etc.)

- Handles regular contributions with precision

- Calculates to multiple decimal places for accuracy

- Tested against professional financial software

The calculator is designed to provide results you can trust for real-world financial planning, investment decisions, and educational purposes.

By choosing our compound interest calculator, you gain access to:

- Precision: Our advanced algorithm ensures every contribution is accurately accounted for, giving you a clear picture of your investment growth.

- Ease of Use: Simply enter your investment details and let our calculator do the complex math for you.

- Comprehensive Insights: Understand how both your principal and contributions grow over time, making informed financial decisions easier.

Experience the power of precise financial planning with our cutting-edge compound interest calculator. Invest smartly and see your wealth grow with confidence!

If you use an annual interest rate but select a monthly compounding frequency, the calculator will divide the annual rate by 12 to calculate the monthly rate. For example, an annual rate of 12% would be converted to a 1% monthly rate.

You can select the desired compounding frequency from the dropdown menu. The available frequencies are daily, monthly, quarterly, semiannually, and annually.